Navigating Ohio’s Sales Tax Landscape: A Comprehensive Guide

Related Articles: Navigating Ohio’s Sales Tax Landscape: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Ohio’s Sales Tax Landscape: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Ohio’s Sales Tax Landscape: A Comprehensive Guide

Ohio’s sales tax system, like many others, is intricate and can be challenging to navigate. This guide aims to shed light on the complexities of Ohio’s sales tax, providing a clear understanding of its structure, rates, and exemptions.

Understanding Ohio’s Sales Tax Structure

Ohio’s sales tax is a consumption tax levied on the sale of tangible personal property and certain services. It is a combined state and local tax, meaning that both the state and individual cities and counties collect sales tax revenue.

Key Components of Ohio’s Sales Tax:

- State Sales Tax: Ohio’s state sales tax rate is currently 5.75%. This rate applies to most taxable goods and services throughout the state.

- Local Sales Taxes: Cities and counties in Ohio can impose their own local sales taxes, ranging from 0% to 1%. These taxes are levied in addition to the state sales tax, resulting in a combined sales tax rate that varies across different locations.

- Combined Sales Tax Rate: The total sales tax rate, encompassing both state and local components, can range from 5.75% to 6.75% depending on the specific location.

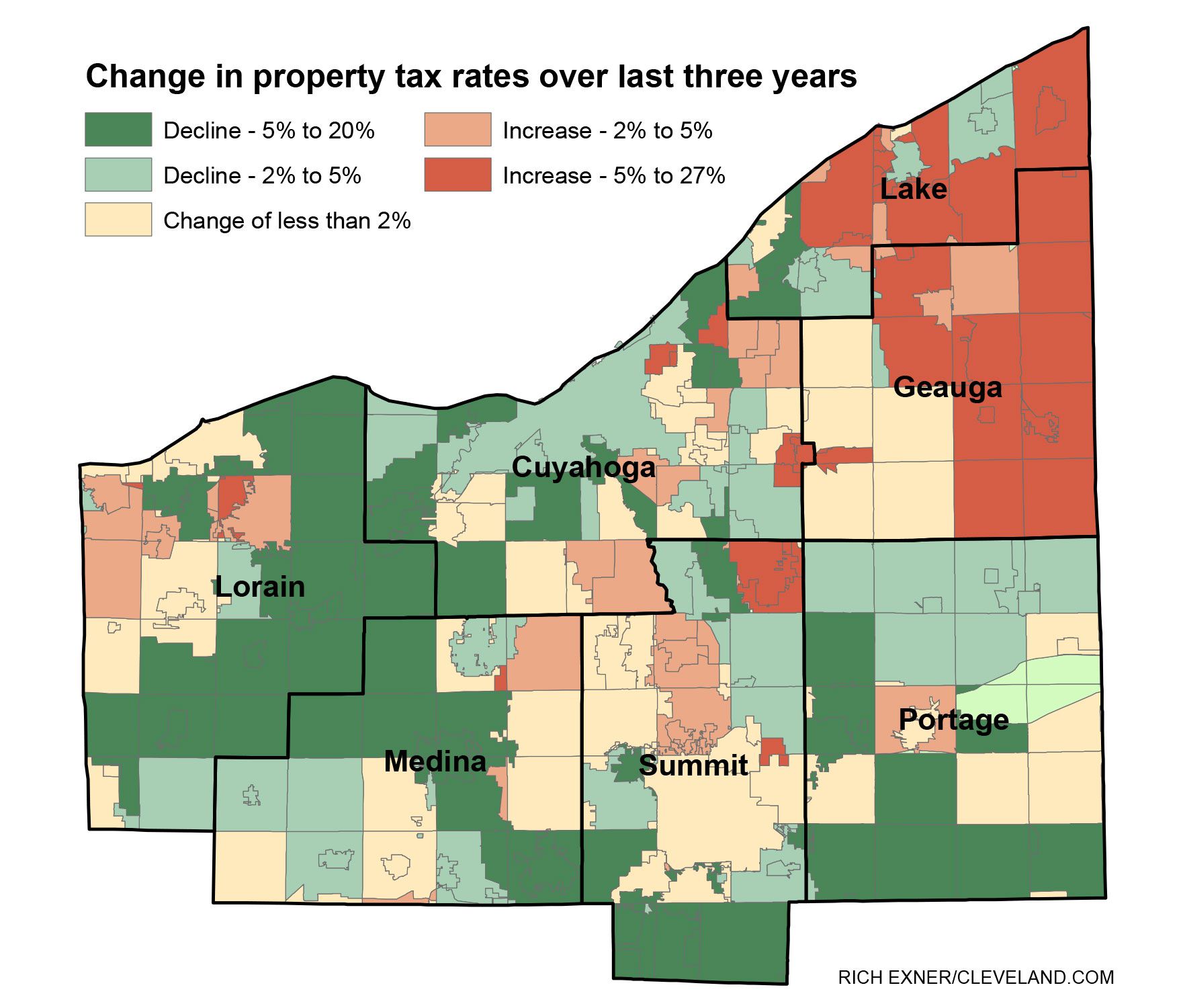

Ohio’s Sales Tax Map: A Visual Representation

The "Ohio Sales Tax Map" is a visual representation of the combined sales tax rates across different cities and counties in the state. This map is a valuable tool for businesses and consumers alike, allowing them to quickly determine the applicable sales tax rate for a particular location.

Accessing the Ohio Sales Tax Map:

The Ohio Department of Taxation (ODT) provides a comprehensive online resource known as the "Sales Tax Rate Lookup Tool." This tool allows users to search for specific locations by city, county, or zip code, and view the corresponding combined sales tax rate.

Benefits of Using the Ohio Sales Tax Map:

- Accurate Sales Tax Calculation: Businesses can ensure they are charging the correct sales tax rate to their customers, avoiding penalties and legal issues.

- Pricing Strategies: Businesses can use the map to understand how sales tax rates might affect their pricing strategies in different locations.

- Consumer Awareness: Consumers can use the map to compare sales tax rates across different areas when making purchasing decisions.

Exemptions and Special Considerations

While most goods and services are subject to Ohio’s sales tax, certain items are exempt from taxation. Some common exemptions include:

- Food: Groceries are generally exempt from sales tax, but there are exceptions for prepared food and certain ingredients.

- Prescription Drugs: Medications prescribed by a licensed physician are exempt from sales tax.

- Clothing and Footwear: Certain items of clothing and footwear are exempt from sales tax, subject to specific thresholds.

- Nonprofit Organizations: Sales made by nonprofit organizations for charitable purposes are often exempt from sales tax.

Sales Tax Regulations and Compliance

Businesses operating in Ohio are responsible for complying with all relevant sales tax regulations. This includes:

- Registration: Businesses must register with the ODT to collect and remit sales tax.

- Reporting and Payment: Businesses are required to file periodic sales tax returns and pay the collected tax to the ODT.

- Recordkeeping: Businesses must maintain accurate records of all sales transactions to ensure compliance with tax laws.

FAQs Regarding Ohio’s Sales Tax Map:

1. Where can I find the Ohio Sales Tax Map?

The Ohio Sales Tax Map is available through the ODT’s online "Sales Tax Rate Lookup Tool."

2. What is the difference between state and local sales taxes?

The state sales tax is a fixed rate applied throughout Ohio, while local sales taxes vary depending on the city or county.

3. How do I determine the combined sales tax rate for a specific location?

Use the ODT’s "Sales Tax Rate Lookup Tool" to search for the location and retrieve the combined sales tax rate.

4. Are there any exemptions from Ohio’s sales tax?

Yes, certain goods and services are exempt from sales tax. These exemptions include groceries, prescription drugs, clothing and footwear, and sales made by nonprofit organizations.

5. What are the penalties for failing to comply with Ohio’s sales tax regulations?

Penalties for non-compliance can include fines, interest charges, and legal action.

Tips for Utilizing the Ohio Sales Tax Map:

- Regularly Check for Updates: The sales tax rates can change, so it’s essential to check for updates on the ODT website periodically.

- Consult with a Tax Professional: If you have complex sales tax questions, it’s always best to consult with a qualified tax professional.

- Use the Map to Optimize Pricing: Businesses can use the map to understand how sales tax rates might affect their pricing strategies in different locations.

- Stay Informed about Exemptions: Businesses should be aware of any exemptions that may apply to their products or services.

Conclusion

Navigating Ohio’s sales tax system requires a comprehensive understanding of the state’s tax structure, rates, and exemptions. The Ohio Sales Tax Map, accessible through the ODT’s online "Sales Tax Rate Lookup Tool," provides a valuable resource for businesses and consumers alike. By utilizing this tool and staying informed about relevant regulations, businesses can ensure compliance and minimize tax-related risks, while consumers can make informed purchasing decisions.

Closure

Thus, we hope this article has provided valuable insights into Navigating Ohio’s Sales Tax Landscape: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!